Venus Metals Corporation Limited subsidiary has entered a binding transaction with a subsidiary (“IGO Subsidiary”) of IGO Limited (ASX: IGO) regarding exploration and, if warranted, development and mineral extraction at the Henderson Nickel-Lithium Project.

Highlights:

-

Farm-in and Joint venture in which IGO Subsidiary can progressively acquire up to a 70% interest in the Project by incurring A$4,000,000 of exploration expenditure on the Project and reimbursing VMC A$1,000,000.

-

IGO Subsidiary will solely fund all Joint Venture expenditures until the completion of a pre-feasibility study in relation to the Project.

-

If IGO Subsidiary completes a pre-feasibility study, it has the right to acquire Venus Subsidiary's 30% interest in the Project for a price based on fair market value less an apportioned aggregation of IGO Subsidiary expenditure incurred in relation to the Project.

Should IGO Subsidiary not acquire the 30% interest, the parties will continue to be associated with an unincorporated joint venture.

Project Background

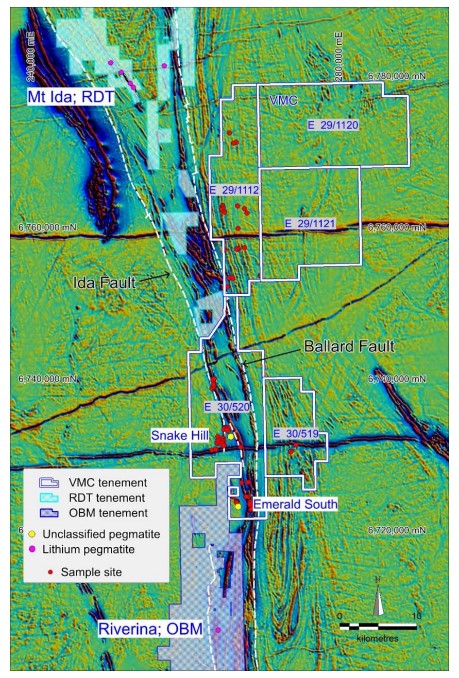

Venus Metals Henderson Lithium Gold Nickel Project comprises five exploration licences covering an approximately 800 km2 area along the central section of the Mt Ida/Ularring Greenstone Belt, 50km northwest of Menzies in the Eastern Goldfields of Western Australia.

VMC tenement E30/520 covers about 25 km strike length of the Mt Ida/Ularring Greenstone Belt, which is historically known for its gold and nickel potential but is also recently recognised as an emerging Lithium Province (RDT ASX release 28 September 2021). Exploration by VMC has identified several outcropping LCT pegmatite clusters spread over a total strike length of some 20km (ASX releases 27 October 2021, 7 February 2022).

Historically, the Mt Ida/Ularring Greenstone Belt has been known to contain Lepidolite-rich lithium pegmatites, but interest in the area as a target for hard rock lithium exploration has increased significantly following recent announcements by Red Dirt Metals (ASX: RDT) of substantial intersections of spodumene-bearing lithium pegmatites at their Mt Ida Project, located directly north from and abutting VMC tenement E30/520 (ASX: RDT) releases 28 September 2021, 14 October 2021).

Lepidolite-rich lithium pegmatites are also known from tenements south of E30/520 as reported by Ora Banda Mining (ASX: OBM). Historical geological mapping identified abundant pegmatite occurrences, several classified as lithium-bearing, over an extensive10km zone surrounding the Riverina Gold Mine (ASX: OBM release 11 October 2021).

VMC has initiated a review into the hard-rock lithium potential of the Henderson tenements. Available historical geological mapping confirms the common presence of pegmatite dykes crosscutting the greenstone sequence at VMC’s Snake Hill and Emerald South Prospects (open file reports A14919, A21888), but no historical data on pegmatite composition has been identified. A sampling and mapping programme has started to determine the distribution and composition of outcropping pegmatites (Refer to VMC ASX release 27 October 2021).

The focus is on tenement E30/520 (90% Venus, 10% Prospector) and E29/1112 (100% Venus) and is targeting potentially lithium-bearing pegmatites.

Identifying LCT pegmatites and the commonly elevated Lithium content of the samples is highly encouraging (ASX: VCM announcement 7.2.22). The highest returned Lithium assays (0.2-3.5% Li2O) are from three samples collected over a strike distance of 50m from a single northeasterly trending pegmatite dyke at Emerald SE.

Identifying LCT pegmatites and the commonly elevated Lithium content of the samples is highly encouraging (ASX: VCM announcement 7.2.22). The highest returned Lithium assays (0.2-3.5% Li2O) are from three samples collected over a strike distance of 50m from a single northeasterly trending pegmatite dyke at Emerald SE.

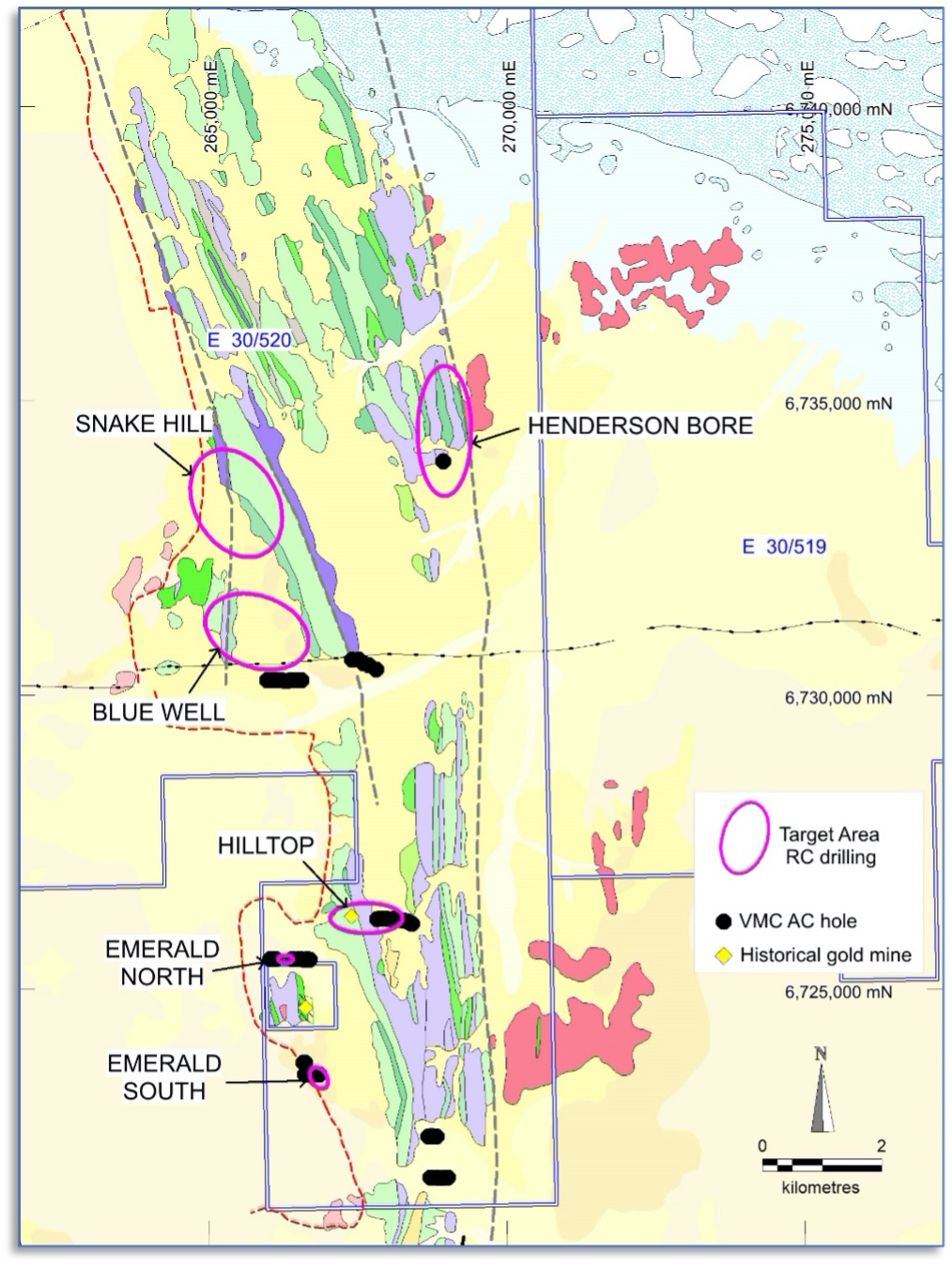

RC drilling 31 drill holes for 2834m was completed to test the outcropping pegmatites at the Snake Hill, Emerald SE and Emerald South Prospects. The Emerald SE area is of particular interest as it shows a relatively high density of outcropping pegmatites with lithium concentrations over 100 ppm LiO2, including a maximum assay of 58000 ppm (5.8 %) LiO2 returned from one narrow, 1m wide pegmatite (refer ASX release 27 May 2022).

Geometry and geological setting of prospective pegmatite bodies will be applied to continued lithium exploration in the northern sector of E30/520.

Gold Exploration:

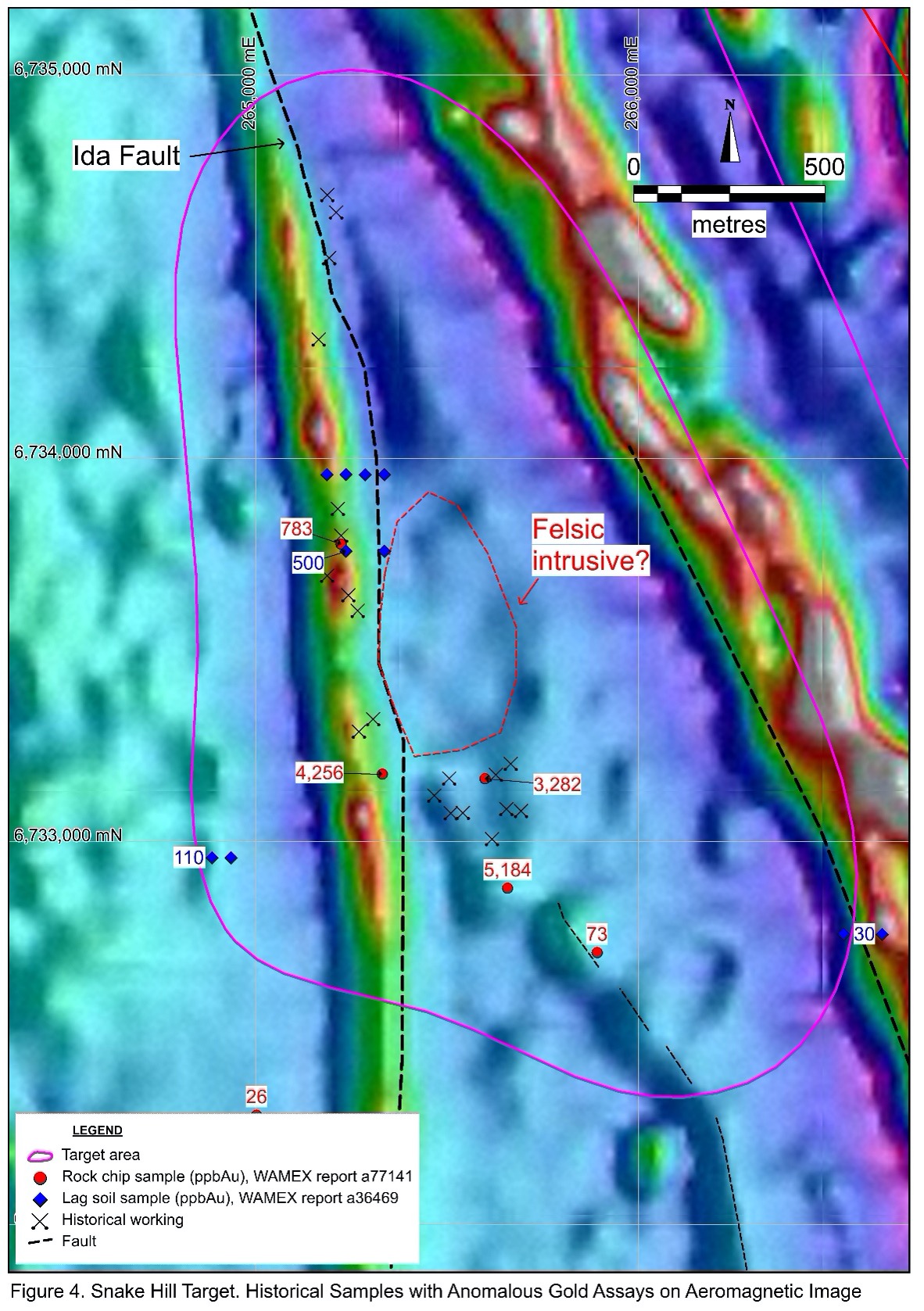

Previous work targeted gold mineralisation associated with two regionally significant fault zones, the Ida Fault and Ballard Fault, that transect the project area (Figure 3) and are considered important controls on gold deposition. An initial AC drilling programme was conducted in July 2021 (refer to ASX release 5 July 2021) and comprised 61 drill holes for a total of 2006m drilled in E30/520 (90% Venus, 10% Prospector). The shallow AC drilling identified new gold mineralised zones at the Emerald South and Henderson Bore Prospects. Significant results include HBAC016 7m @ 1.13 g/t Au from 45m, including 1m @ 4.57 g/t Au from 49m; HBAC060 2m @ 2.2 g/t Au from 19m, including 1m @ 4.09 g/t Au from 19m. Further reverse circulation (RC) drilling is planned to test the lateral and depth extent of the newly discovered gold mineralisation and to test previously identified gold targets in areas with shallow cover. This includes the history, consequently, al Hilltop gold workings where exploratory rock-chip sampling of mullock returned 77.2 g/t Au and 2.4 g/t Au (refer to ASX release 9 September 2021).

Two regionally significant fault zones, the Ida Fault and Ballard Fault define the boundaries of the greenstone sequence and are considered to have played important controls on gold deposition. Significant gold mines associated with those structures in proximity to the Henderson Project include the historical First Hit Mine (Viking Mines; 7km south), the Riverina Mine (Ora Banda Mining; 15km south) and the historical Bottle Creek Mine (30km north) (Figure 1). Historical gold workings within the general project area include the Emerald Mine (excised from VMC tenement) and the Hilltop Mine.

VMC has conducted a reconnaissance Phase 1 air-core (AC) drilling programme on tenement E30/520 (90% Venus) to test gold targets in areas with an extensive cover that were identified in a recent geological review of the area (refer ASX release 8 May 2020).

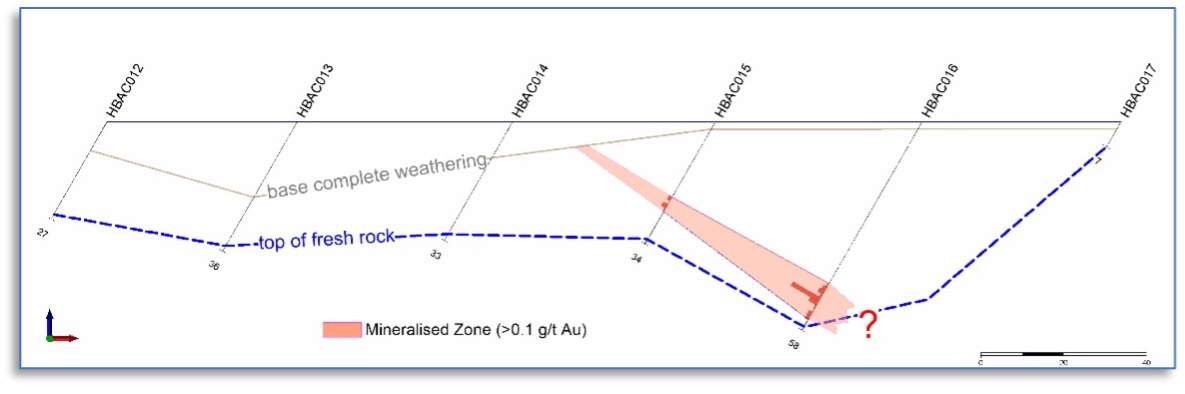

The shallow AC drilling identified new gold mineralised zones at the Emerald South and Henderson Bore Prospects. Significant results include:

HBAC016 7m @ 1.13 g/t Au from 45m,

including 1m @ 4.57 g/t Au from 49m

HBAC060 2m @ 2.2 g/t Au from 19m,

including 1m @ 4.09 g/t Au from 19m

Further reverse circulation (RC) drilling is planned to test the lateral and depth extent of the newly discovered gold mineralisation and to test previously identified gold targets in areas with shallow cover. This includes the historical Hilltop gold workings where exploratory rock-chip sampling of mullock returned 77.2 g/t Au and 2.4 g/t Au.

Henderson Project Tenements on Aeromagnetic Image

Location of VMC AC drill collars and target areas for follow-up RC drilling over GSWA 100,000 scale outcrop geology

Schematic section at 6723550mN (looking north). Interpreted mineralisation outline, defined by 100 ppb Au intersections of Phase 1 AC drilling, dips gently in an easterly direction and is open at depth.

Schematic section at 6723550mN (looking north). Interpreted mineralisation outline, defined by 100 ppb Au intersections of Phase 1 AC drilling, dips gently in an easterly direction and is open at depth.